A platform for AI financial models, enabling advanced analytics, predictive insights, and automated decision-making for risk assessment, trading, and portfolio optimization.

Unlock Decentralized AI Intelligence

Collaborative, privacy-preserving AI models for portfolio optimization, risk prediction, and equitable growth

Core Pillars of GeFi

AI Finance for All, Powered by DeFi

Equitable Collaboration

Networks train AI locally on private data; share only encrypted updates (e.g., FedAvg) for global improvements.

DeFi Incentives

Smart contracts reward contributions with tokens; marketplace lets anyone subscribe to refined models.

Impact

Boosts resilient economies—democratizes AI for all, no silos, zero data leaks.

Federated AI Workflow

How Models Evolve

Key: Privacy via homomorphic encryption & differential privacy. Evolve models collaboratively.

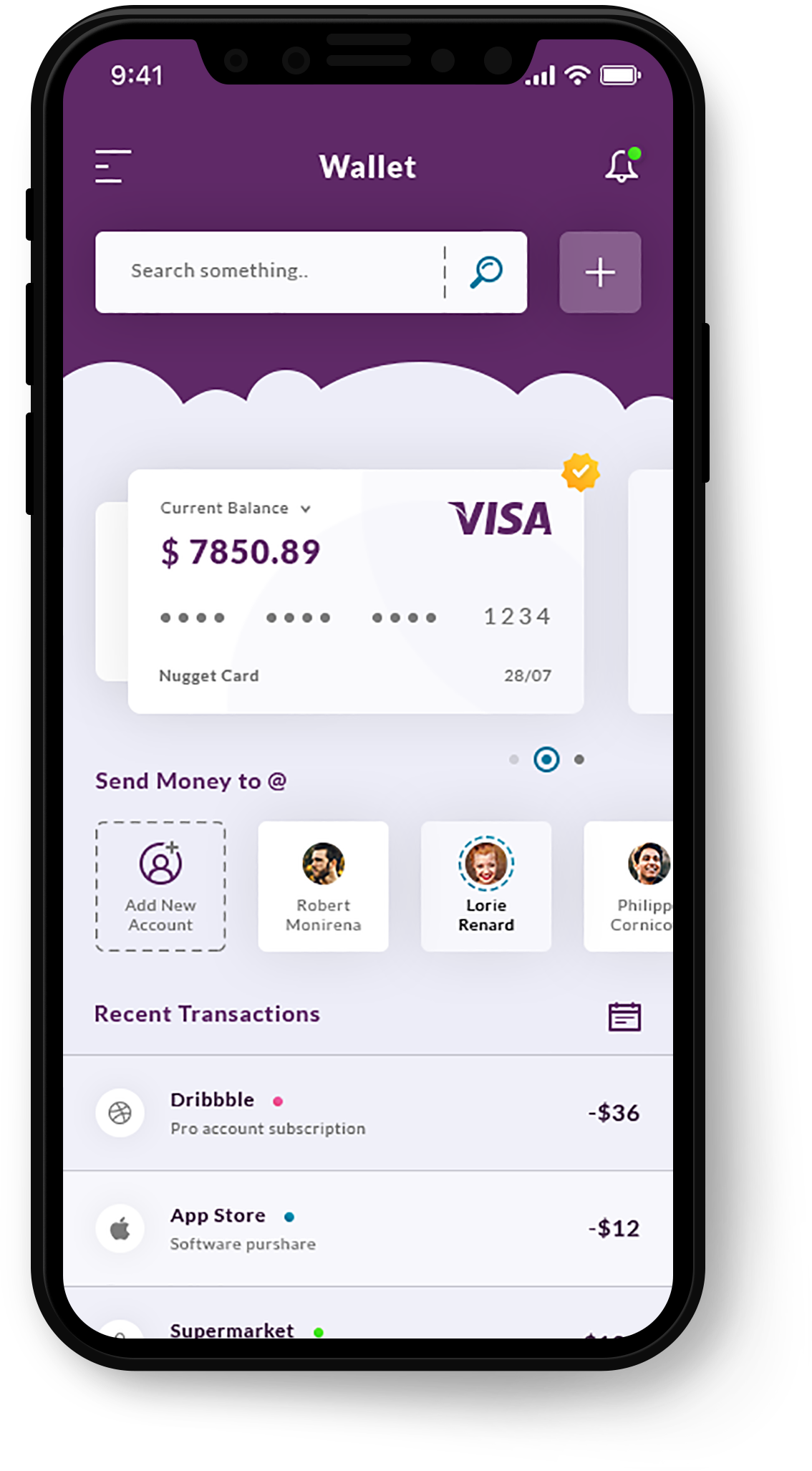

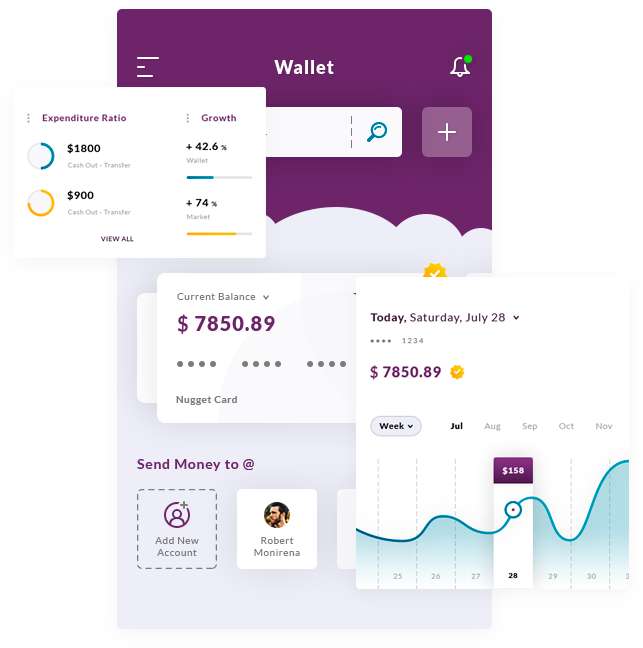

AI-Powered Portfolio Management

From Overview to Optimization

Live Insights at a Glance

Track $247K+ investments with +$12K P&L, 18.4% returns, and 2.1 Sharpe Ratio. Outperform markets by +5.2% using conservative/aggressive AI models.

Risk Distribution & Confidence

Allocate across stocks (60%), bonds (30%), crypto (10%) at moderate risk. AI confidence: 94.2%—rebalance with one click or manual override.

Manage Active Models

Run 3+ models like Quantum Risk Predictor (+12.5%, 94.2% accuracy, $99/mo) and Momentum Tracker Pro (+8.7%, $149/mo). Total perf: +19.1%, fees: $327.

Incentivized Contributions

Free interactions feed global profilers—earn tokens via smart contracts for model improvements.

Auto-Rebalance Strategies

Fix 5% drift with $10K trades (sell $5K stocks, buy $5K bonds). Set quarterly frequency, tax-loss harvesting, and 5% thresholds.

Download & Act

Export reports and execute AI-driven adjustments, reflecting model psychology for balanced, bias-mitigated decisions.

Choose Your Path to Collaborative AI

Optimise the Hedge, Unleash the Edge

Free

| Free models |

| 500K API Calls/mo |

| 5GB Secure Storage |

| Manual rebalancing |

| Community forums |

| Documentation |

| Monetization |

Pro

| Up to 3 paid basic models |

| Unlimited API Calls |

| 50GB Storage |

| Auto-rebalancing |

| Automated reports + notifier |

| Email/chat support |

| Marketplace subscriptions |

Enterprise

| Unlimited models |

| Priority APIs |

| Unlimited Storage |

| Advanced dashboards |

| Regulator integration |

| 24/7 dedicated support |

| Equity tokens |

Frequently Asked Questions

"Email us for more"

No raw data leaves your environment—only encrypted updates aggregate via Secure Layer (FedAvg), with ZKPs for compliance.

Yes, anytime from dashboard. Access continues to billing cycle end.

Credit cards, PayPal, bank transfers for Enterprise. Stripe-secured.

Update models, billing, and preferences in dashboard; 24/7 help available.

PCI-compliant with 256-bit SSL and zero retention.

Download from Billing section or emailed post-payment.

Yes, for startups/students—contact with proof.

Free tier is unlimited trial; upgrade seamlessly.